It’s not often that I find a penny stock I think is worth my money. After all, all the good companies’ share prices have usually become quite high already.

But with a 5.3% dividend yield and an 11.5% compound annual growth rate in the share price over the past decade, this company could be different. As I write, Sirius Real Estate (LSE:SRE) is selling at just £0.98 per share and 30% below its all-time high.

Investing in German property

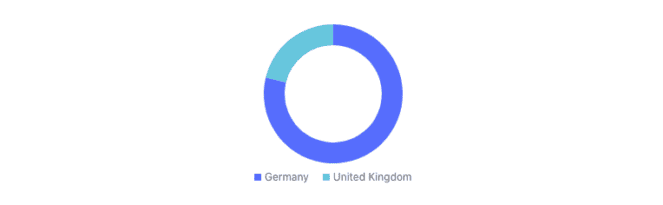

The company invests in and acquires commercial property to provide workspace for small-to-medium-sized businesses in Germany and the UK. However, 79% of its revenue comes from the former country.

Should you invest £1,000 in Close Brothers right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Close Brothers made the list?

I’ve broken down its revenue from operations into two distinct categories:

- Investment property income

- Managed property income

The difference between these two is that through the managed property segment it generates revenue from properties it doesn’t own but helps to operate.

I like that the business has a wide range of office offerings. Everything from traditional business spaces to workshops are available through Sirius. This allows its target market to be slightly wider than if it just offered properties for traditional use cases.

Analysts expect high growth

Analysts are predicting its earnings before interest, taxes, depreciation and amortisation (EBITDA) to grow at an 11.5% compound annual growth rate over the next two years.

That’s important to me because it means the company should have a healthy future ahead of it (at least in the medium term), according to a lot of experts in the field. It helps me decide if I’m getting a good deal or not. After all, I want growth, not just a cheap price.

Is it value for money?

Right now, the company has a price-to-tangible-book ratio of 1.11, which means investors are paying just slightly more than the total value of physical assets owned by the firm.

But its price-to-earnings (P/E) ratio without non-recurring items is just 13.4. That’s way lower than its norm of around 18 over the past decade.

Considering both of those metrics, I think it’s reasonable for me to consider the shares as undervalued.

A look at the risks

Of course, the real estate business is renowned for the use of debt to finance property purchases, and this company is no exception. It’s one of the biggest risks I see with the investment.

As I write, it has about equal liabilities to equity. While that’s not terrible for its industry, it’s worse than normal for Sirius. The pandemic seriously knocked the businesses Sirius relies on for its rental income. So, I’m not surprised it’s got more debt than usual at the moment.

This could mean that if the firm gets hit by another crisis, the negative effects could be even more pronounced because it’s already been weakened. As the business is heavily dependent on Germany, it would only take an issue in that one country for things to go awry.

I still love the investment

Despite the risks, Sirius is on my watchlist because I find the dividend yield of over 5% and good appreciation in share price over the past decade really promising.

So, I’ll look at potentially investing in it later in the month.